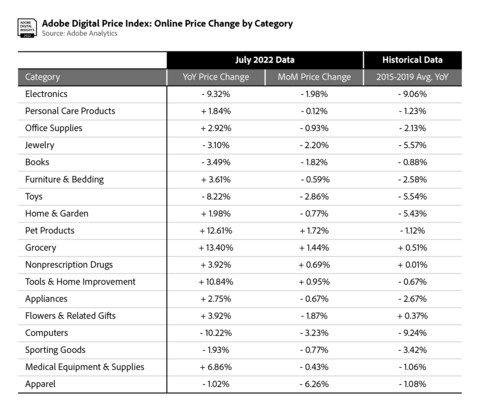

Adobe announced the latest online inflation data from the Adobe Digital Price Index (DPI), powered by Adobe Analytics. In July 2022, online prices decreased 1%year-over-year (YoY)—after increasing 0.3% YoY in June and 2% YoY in May—and dropped 2% on a monthly basis.

July is the first month where e-commerce entered deflation, after 25 consecutive months of persistent inflation online. Most of the categories tracked by the DPI (14 out of 18) saw month-over-month (MoM) price decreases in July.

Prices for electronics, the largest category in e-commerce with 18.6% share of spend in 2021, fell sharply and decreased 9.3% YoY (down 2% MoM). This is a greater YoY decrease than June (down 7.3% YoY) and May (down 6.5% YoY). Prices for apparel fell 1% YoY (down 6.3% MoM), marking the second consecutive month where prices fell after dropping 0.1% YoY in June. Apparel prices had increased for 14 consecutive months since April 2021, with prices having spiked in recent months (up 9% YoY in May, 12.3% YoY in April and 16.3% YoY in March). Toy prices fell significantly, dropping 8.2% YoY (down 2.9% MoM), a record YoY low for the category in the last 31 months. Food costs remained high however, with grocery prices rising 13.4% YoY (up 1.4% MoM), a record YoY high and the largest increase of any category.

In July, consumers spent $73.7 billion online, $400 million less than the prior month ($74.1 billion). On a YoY basis however, e-commerce spend in July grew 20.9%, with Prime Day driving record online sales for the retail industry overall. Online spending in July also decreased compared to May ($78.8 billion) and April ($77.8 billion). E-commerce demand remains resilient in a year-to-date basis, with consumers spending $525.4 billion online in 2022 so far, growing 9.2% YoY.

“Wavering consumer confidence and a pullback in spending, coupled with oversupply for some retailers, is driving prices down in major online categories like electronics and apparel,” said Patrick Brown, vice president of growth marketing and insights, Adobe. “It provides a bit of relief for consumers, as the cost of food continues to rise both online and in stores.”

The DPI provides the most comprehensive view into how much consumers pay for goods online, as e-commerce expands to new categories and as brands focus on making the digital economy personal. Powered by Adobe Analytics, it analyzes one trillion visits to retail sites and over 100 million SKUs across 18 product categories: electronics, apparel, appliances, books, toys, computers, groceries, furniture/bedding, tools/home improvement, home/garden, pet products, jewelry, medical equipment/supplies, sporting goods, personal care products, flowers/related gifts, non-prescription drug and office supplies.

In July, 11 of the 18 categories tracked by the DPI saw YoY price increases, with groceries rising the most. Price drops were observed in seven categories: electronics, jewelry, books, toys, computers, sporting goods and apparel.

Only four of the 18 categories in the DPI saw price increases MoM. Price drops were observed across 14 categories including electronics, personal care products, office supplies, jewelry, books, furniture/bedding, toys, home/garden, appliances, flowers/related gifts, computers, sporting goods, medical equipment/supplies and apparel.

Notable categories in the Adobe Digital Price Index for July:

- Electronics: Prices were down 9.3% YoY (down 2% MoM), bringing it back to pre-pandemic levels when electronic prices fell 9.1% YoY on average between 2015 and 2019. As the biggest category in e-commerce by share of spend, price movements have an outsized impact on overall inflation online.

- Apparel: Prices were down 1% YoY, while falling significantly on a monthly basis (down 6.3% MoM). This is the first notable YoY decrease for the category, as prices only fell by 0.1% YoY in June. It comes after 14 consecutive months where prices had risen consistently, reversing a predictable pattern of heavy discount periods.

- Toys: Prices were down 8.2% YoY (down 2.9% MoM), the largest YoY drop for the category since December 2019, when prices were down 10% YoY during the holiday shopping season. This is the 16th consecutive month of deflation for the category, after prices had risen 0.2% YoY in March 2021.

- Groceries: Prices continued to surge and rose 13.4% YoY (up 1.4% MoM), more than any other category. It is a new YoY record, following a 12.4% YoY increase in June, a 11.7% YoY increase in May and a 10.3% YoY increase in April—all previous record highs. Grocery prices have risen for 30 consecutive months, and it remains the only category to move in lockstep with the Consumer Price Index on a long-term basis.

- Pet Products : Prices were up 12.6% YoY (up 1.7% MoM), a record YoY high for the category. This follows a 11.3% YoY increase in June, and a 9.1% YoY increase in May. Online inflation for pet products has now been observed for 27 consecutive months, as pet ownership surged during the COVID-19 pandemic and demand for related goods remains high.

Methodology

The DPI is modeled after the Consumer Price Index (CPI), published by the U.S. Bureau of Labor Statistics and uses the Fisher Price Index to track online prices. The Fisher Price Index uses quantities of matched products purchased in the current period (month) and a previous period (previous month) to calculate the price changes by category. Adobe’s analysis is weighted by the real quantities of the products purchased in the two adjacent months.

Powered by Adobe Analytics, Adobe uses a combination of Adobe Sensei, Adobe’s AI and machine learning framework, and manual effort to segment the products into the categories defined by the CPI manual. The methodology was first developed alongside renowned economists Austan Goolsbee and Pete Klenow.

Amplitude is a product analytics platform, enabling businesses to track visitors with the help of collaborative analytics. The platform leverages the capabilities of

Amplitude is a product analytics platform, enabling businesses to track visitors with the help of collaborative analytics. The platform leverages the capabilities of

Zoho Social, a part of Zoho’s suite of 50+ products, is a comprehensive social media management platform for businesses and agencies. The Zoho Social dashboard includes a robust set of features, such as Publishing Calendar, Bulk Scheduler, and Approval Management to offer businesses all the essential social media publishing tools. Its monitoring tools help enterprises track and respond to relevant social conversations.

Zoho Social, a part of Zoho’s suite of 50+ products, is a comprehensive social media management platform for businesses and agencies. The Zoho Social dashboard includes a robust set of features, such as Publishing Calendar, Bulk Scheduler, and Approval Management to offer businesses all the essential social media publishing tools. Its monitoring tools help enterprises track and respond to relevant social conversations.

Microsoft Dynamics 365 represents a robust cloud-based CRM solution with features such as pipeline assessment, relationship analytics, and conversational intelligence. It utilises AI-powered insights to provide actionable intelligence via predictive analytics, lead scoring, sentiment analysis, etc. Currently, Microsoft operates in 190 countries and is made up of more than 220,000 employees worldwide.

Microsoft Dynamics 365 represents a robust cloud-based CRM solution with features such as pipeline assessment, relationship analytics, and conversational intelligence. It utilises AI-powered insights to provide actionable intelligence via predictive analytics, lead scoring, sentiment analysis, etc. Currently, Microsoft operates in 190 countries and is made up of more than 220,000 employees worldwide.

HubSpot is an inbound marketing, sales, and customer service software provider, offering robust CRM and automation solutions. Some of its products include Marketing Hub, Sales Hub, Operations Hub, Content Hub, Commerce Hub, Marketing Analytics and Dashboard Software. Guided by its inbound methodology, HubSpot enables companies to prioritise innovation and customer success.

HubSpot is an inbound marketing, sales, and customer service software provider, offering robust CRM and automation solutions. Some of its products include Marketing Hub, Sales Hub, Operations Hub, Content Hub, Commerce Hub, Marketing Analytics and Dashboard Software. Guided by its inbound methodology, HubSpot enables companies to prioritise innovation and customer success.

Monday.com is a project management software company, offering a cloud-based platform that enables businesses

Monday.com is a project management software company, offering a cloud-based platform that enables businesses  Headquartered in San Mateo, California, Freshworks is a global AI-powered business software provider. Its tech stack includes a scalable and comprehensive suite for IT, customer support, sales, and marketing teams, ensuring value for immediate business impact. Its product portfolio includes Customer Service Suite, Freshdesk, Freshchat, Freshcaller, Freshsuccess, and Freshservice. Freshservice for Business Teams has helped several global organisations to enhance their operational efficiency.

Headquartered in San Mateo, California, Freshworks is a global AI-powered business software provider. Its tech stack includes a scalable and comprehensive suite for IT, customer support, sales, and marketing teams, ensuring value for immediate business impact. Its product portfolio includes Customer Service Suite, Freshdesk, Freshchat, Freshcaller, Freshsuccess, and Freshservice. Freshservice for Business Teams has helped several global organisations to enhance their operational efficiency.

Talkdesk offers an innovative AI-powered customer-centric tech stack to its global partners. The company provides generative AI integrations, delivering industry-specific solutions to its customers. Talkdesk CX Cloud and Industry Experience Clouds utilise modern machine learning and language models to enhance contact centre efficiency and client satisfaction.

Talkdesk offers an innovative AI-powered customer-centric tech stack to its global partners. The company provides generative AI integrations, delivering industry-specific solutions to its customers. Talkdesk CX Cloud and Industry Experience Clouds utilise modern machine learning and language models to enhance contact centre efficiency and client satisfaction.

The company offers comprehensive cloud-based solutions, such as Microsoft Dynamics 365, Gaming Consoles, Microsoft Advertising, Copilot, among other things, to help organisations offer enhanced CX and ROI. Its generative-AI-powered speech and voice recognition solutions,such as Cortana and Azure Speech Services empowers developers to build intelligent applications.

The company offers comprehensive cloud-based solutions, such as Microsoft Dynamics 365, Gaming Consoles, Microsoft Advertising, Copilot, among other things, to help organisations offer enhanced CX and ROI. Its generative-AI-powered speech and voice recognition solutions,such as Cortana and Azure Speech Services empowers developers to build intelligent applications. IBM is a global hybrid cloud and AI-powered

IBM is a global hybrid cloud and AI-powered  Uniphore is an enterprise-class, AI-native company that was incubated in 2008. Its enterprise-class multimodal AI and data platform unifies all elements of voice, video, text and data by leveraging Generative AI, Knowledge AI, Emotion AI and workflow automation. Some of its products include U-Self Serve, U-Assist, U-Capture, and U-Analyze. Its Q for Sale is a conversational intelligence software that guides revenue teams with AI-powered insights, offering clarity on how to effectively keep prospects engaged.

Uniphore is an enterprise-class, AI-native company that was incubated in 2008. Its enterprise-class multimodal AI and data platform unifies all elements of voice, video, text and data by leveraging Generative AI, Knowledge AI, Emotion AI and workflow automation. Some of its products include U-Self Serve, U-Assist, U-Capture, and U-Analyze. Its Q for Sale is a conversational intelligence software that guides revenue teams with AI-powered insights, offering clarity on how to effectively keep prospects engaged. Google Cloud accelerates every organisation’s ability to digitally transform its business. Its enterprise-grade solutions leverage modern technology to solve the most criticial business problems

Google Cloud accelerates every organisation’s ability to digitally transform its business. Its enterprise-grade solutions leverage modern technology to solve the most criticial business problems  8×8 offers out-of-the-box contact centre solutions, assisting all-size businesses to efficiently meet customer needs and preferences. It offers custom CRM integrations support and integrates effortlessly with third-party CRMs like Salesforce, Microsoft Dynamics, Zendesk, and more. Offering global support in all time zones & development teams in 5 continents, its patented geo-routing solution ensures consistent voice quality.

8×8 offers out-of-the-box contact centre solutions, assisting all-size businesses to efficiently meet customer needs and preferences. It offers custom CRM integrations support and integrates effortlessly with third-party CRMs like Salesforce, Microsoft Dynamics, Zendesk, and more. Offering global support in all time zones & development teams in 5 continents, its patented geo-routing solution ensures consistent voice quality. Sprinklr is a comprehensive enterprise software company for all customer-focused functions. With advanced AI, Sprinklr’s unified customer experience management (Unified-CXM) platform lets organisations offer human experiences to every customer, every time, across any modern channel.

Sprinklr is a comprehensive enterprise software company for all customer-focused functions. With advanced AI, Sprinklr’s unified customer experience management (Unified-CXM) platform lets organisations offer human experiences to every customer, every time, across any modern channel.

Upland offers a comprehensive suite of contact centre and customer service solutions with products including InGenius, Panviva, Rant & Rave, and RightAnswers. InGenius enables organisations to connect their existing phone system with CRM, further enhancing agent productivity. Panviva provides compliant and omnichannel capabilities for highly regulated industries. Whereas, Rant & Rave, and RightAnswers are its AI-powered solutions,

Upland offers a comprehensive suite of contact centre and customer service solutions with products including InGenius, Panviva, Rant & Rave, and RightAnswers. InGenius enables organisations to connect their existing phone system with CRM, further enhancing agent productivity. Panviva provides compliant and omnichannel capabilities for highly regulated industries. Whereas, Rant & Rave, and RightAnswers are its AI-powered solutions,

Hootsuite, headquartered in Vancouver, is a social media management platform that streamlines the process of managing multiple social media accounts. Some of its core offerings include social media content planning and publishing, audience engagement tools, analytics and social advertising. Its easy-to-integrate capabilities help marketing teams to schedule and publish social media posts efficiently.

Hootsuite, headquartered in Vancouver, is a social media management platform that streamlines the process of managing multiple social media accounts. Some of its core offerings include social media content planning and publishing, audience engagement tools, analytics and social advertising. Its easy-to-integrate capabilities help marketing teams to schedule and publish social media posts efficiently.

Brandwatch enables businesses to build and scale the optimal strategy for their clients with intuitive, use-case-focused tools that are easy and quick to master. Bringing together consumer intelligence and social media management, the company helps its users react to the trends that matter, collaborate on data-driven content, shield the brand from threats and manage all the social media channels at scale.

Brandwatch enables businesses to build and scale the optimal strategy for their clients with intuitive, use-case-focused tools that are easy and quick to master. Bringing together consumer intelligence and social media management, the company helps its users react to the trends that matter, collaborate on data-driven content, shield the brand from threats and manage all the social media channels at scale.

Adobe Experience Cloud offers a comprehensive set of applications, capabilities, and services specifically designed to address day-to-day requirement for personalised customer experiences at scale. Its platform helps play an essential role in managing different digital content or assets to improve customer happiness. Its easy-to-optimise content gives users appropriate marketing streams, ensuring product awareness.

Adobe Experience Cloud offers a comprehensive set of applications, capabilities, and services specifically designed to address day-to-day requirement for personalised customer experiences at scale. Its platform helps play an essential role in managing different digital content or assets to improve customer happiness. Its easy-to-optimise content gives users appropriate marketing streams, ensuring product awareness. Salesforce-owned Tableau is an AI-powered analytics and business intelligence platform, offering the breadth and depth of capabilities that serve the requirements of global enterprises in a seamless, integrated experience. Marketers can utilise generative AI models, AI-powered predictions, natural language querying, and recommendationsons.

Salesforce-owned Tableau is an AI-powered analytics and business intelligence platform, offering the breadth and depth of capabilities that serve the requirements of global enterprises in a seamless, integrated experience. Marketers can utilise generative AI models, AI-powered predictions, natural language querying, and recommendationsons. Contentsquare is a cloud-based digital experience analytics platform, helping brands track billions of digital interactions, and turn those digital

Contentsquare is a cloud-based digital experience analytics platform, helping brands track billions of digital interactions, and turn those digital

Zoho Corporation offers innovative and tailored software to help leaders grow their business. Zoho’s 55+ products aid sales and marketing, support and collaboration, finance, and recruitment requirements. Its customer analytics capabilities come with a conversational feature, Ask Zia. It enables users to ask questions and get insights in the form of reports and widgets in real-time.

Zoho Corporation offers innovative and tailored software to help leaders grow their business. Zoho’s 55+ products aid sales and marketing, support and collaboration, finance, and recruitment requirements. Its customer analytics capabilities come with a conversational feature, Ask Zia. It enables users to ask questions and get insights in the form of reports and widgets in real-time. Fullstory is a behavioural data platform, helping C-suite leaders make informed decisions by injecting digital behavioural data into its analytics stack. Its patented technology uncovers the power of quality behavioural data at scale, transforming every digital visit into actionable insights. Enterprises can increase funnel conversion and identify their highest-value customers effortlessly.

Fullstory is a behavioural data platform, helping C-suite leaders make informed decisions by injecting digital behavioural data into its analytics stack. Its patented technology uncovers the power of quality behavioural data at scale, transforming every digital visit into actionable insights. Enterprises can increase funnel conversion and identify their highest-value customers effortlessly.

Started in 2005 in a Sweden-based small town, Norrköping, Voyado offers a customer experience cloud platform that includes a customer loyalty management system. This platform helps businesses design and implement customer loyalty programs, track customer

Started in 2005 in a Sweden-based small town, Norrköping, Voyado offers a customer experience cloud platform that includes a customer loyalty management system. This platform helps businesses design and implement customer loyalty programs, track customer

TapMango provides a comprehensive, customisable, flexible and feature-rich customer loyalty program. The loyalty tools include an integrated suite of customised consumer-facing technology, easy-to-use merchant tools, and automation algorithms, all aimed at enhancing customer experience. Adaptable to any industry, TapMango’s platform helps merchants compete with larger chains, converting customer one-time purchases into profitable spending habits.

TapMango provides a comprehensive, customisable, flexible and feature-rich customer loyalty program. The loyalty tools include an integrated suite of customised consumer-facing technology, easy-to-use merchant tools, and automation algorithms, all aimed at enhancing customer experience. Adaptable to any industry, TapMango’s platform helps merchants compete with larger chains, converting customer one-time purchases into profitable spending habits.

Adobe Experience Cloud offers a comprehensive set of applications, capabilities, and services specifically designed to address day-to-day requirements for personalised customer experiences at scale. Its innovative platform has played an essential role in managing different digital content or assets, to improve customer happiness or satisfaction. Some of its products include Adobe Gen Studio, Experience Manager Sites, Real-time CDP, and Marketo Engage.

Adobe Experience Cloud offers a comprehensive set of applications, capabilities, and services specifically designed to address day-to-day requirements for personalised customer experiences at scale. Its innovative platform has played an essential role in managing different digital content or assets, to improve customer happiness or satisfaction. Some of its products include Adobe Gen Studio, Experience Manager Sites, Real-time CDP, and Marketo Engage.